Why Should Fintech Brands Invest in Influencer Marketing?

“If you look at most business news channels, they primarily focus on market updates; the new investor needs education.”- Pranjal Kamra

(Finance influencer)

Fintech brands have been quite slow in embracing social media marketing or advertisements on social accounts. However, they now realize the profit-driving benefits that this channel provides and aim to establish a firm online presence. Fintech brands are also branching out and discovering the powerful world of influencer marketing. Influencer marketing is on the rise. Influencers are dramatically shaping buying behaviors.

There is no denying that the fashion, beauty, travel, and fitness industries were some of the earliest adopters of influencer marketing. However, influencer marketing has a lot of potential for financial services companies. Influencer marketing brings trust and authenticity, which is a highly valued factor when it comes to investing your hard-earned money. Some of the early adopters of influencer marketing from the fintech niche were ICICI, INGVysya, HDFC Bank, Angel Broking, and Axis Bank, among many others. Before we jump into why Fintech brands should invest in influencer marketing, let us cover the basics.

What is influencer marketing?

Influencer marketing essentially is a type of marketing that focuses on the key leaders to drive your brand’s message to the larger market. Rather than directly marketing to a large group of consumers, you collaborate with influencers who in turn create authentic content to promote your brand’s product or service.

Influencer marketing often goes hand-in-hand with social media and content marketing. Influencers have the ability to improve a business’s reach and visibility by targeting the right audience and demonstrating authority. This is a valuable asset and gives fintech brands a chance to reach a wider audience as compared to traditional advertising. This is why Confluencr has successfully leveraged its reach for multiple brands including Motilal Oswal – with both achieving desired results, and on occasion – even more.

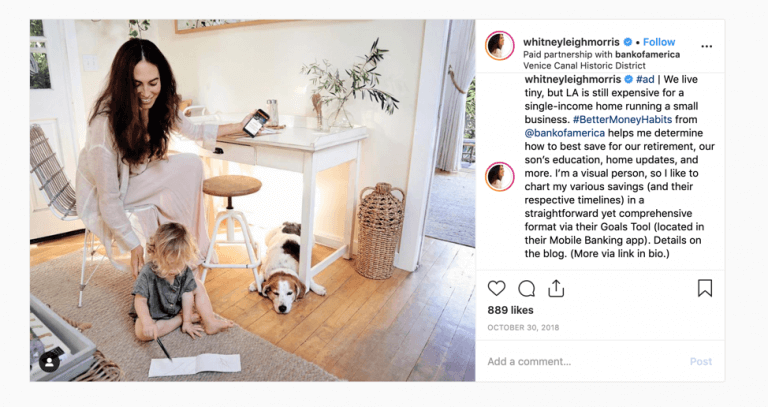

Many influencer campaigns encompass social media marketing wherein influencers are expected to promote your brand through their personal social media channels.

5 reasons why Fintech brands should invest in Influencer marketing

1. Reach millennials and Gen Z

Millennials constitute 34% of the country’s population whereas 29% of the total population in India is GenZ. Both Gen Z and millennials are digital natives and are trendsetters. These are also the people who have a genuine interest in knowing more about finances in order to secure their future, and fintech brands need to meet them where they already are. Being inspired by social media, day in and day out, it is necessary for brands to be discovered on these platforms. Influencer marketing makes it easier for brands to show themselves up in front of their target audience, thus making them more likely to be approached.

An influencer who has the same target market and understands the values of your brands can promote your products and services to new audiences through relatable content.

An influencer can create content that is related to real-life experiences like saving for a wedding, buying a home, investing in stocks, etc. We at Confluencr exactly tapped into this emotional connection of the influencers with their audience when we planned an influencer marketing campaign for Angel Broking. The aim was to drive more downloads and engagement for their stock market apps and with a unique strategy in place, we were able to garner satisfying results. From our experience, we yet again realized the power of storytelling. Influencers use this power of stories and add personal anecdotes that successfully aid in humanizing fintech products that otherwise might seem alien. This type of quality content is more about promoting lifestyle benefits than flashing a ‘buy now’ or ‘apply now’ button to your readers.

2. Build trust through creating a personal connection

3. Boost credibility and higher engagements

People trust recommendations from other people, more than they trust you as a salesman. Influencers are those people on social media platforms that are trusted by their audience, more than anybody else. Therefore, partnering with influencers can help boost your credibility. This is a modern-day version of ‘word of mouth’ and ‘product placement marketing.’ Additionally, with so many ads, people have seemed to become desensitized toward display ads. Influencer content does not suffer from the same emotions and can attract audience attention and lead to increased engagement through liking, sharing, or adding a comment. Influencers can also drive other actions like clicks to your fintech brand’s social profile, visits to the websites, entries to a contest, increased number of downloads, etc.

Fintech products don’t usually generate the warm and fuzzy emotions that other products do. Especially since the 2008 financial crisis, the industry has been trying to maintain a positive reputation. Influencer marketing allows your brand to highlight your brand’s positive image that goes beyond the products.

When you partner with a finance influencer who people follow as their financial advisor and who is passionate about their community or even a certain cause, you can validate your brand in honest and genuine ways.

4. Support community and charitable efforts

5. Legal considerations

Due diligence is vital for any fintech company that is planning to step into influencer marketing. All influencers and brands, regardless of their industry and niche, are subjected to Federal (FTC) regulations. However, financial services companies have to follow the rules that are set forth by the Financial Industry Regulatory Authority (FINRA). Many national advertising laws require their posts to declare that they are #sponsored or an #ad.

From influencer pitching to content reviews, disclosures, and everything in between, there are many factors to consider. Compliance should be practiced from the very beginning of any campaign. For example, an influencer cannot guarantee a fund performance or suggest a specific investment fund.

Examples of Fintech solutions with an influencer-led approach

The surge in influencer posts over the past few months has showcased that the fintech industry has doubled down on the $15 billion influencer marketing sector.

1. Upstox

Upstox offers among the best market trading apps in the marketplace. Confluencr implemented an influencer marketing strategy for Upstox across YouTube as they aimed to boost their growth. We collaborated with leading influencers in the financial sector and showcased the features of their app through visually appealing videos.

Revolut aims at employing influencers for specialized campaigns with carefully selected partners and a focus on competition incentives and referrals.

2. Revolut

3. Starling Bank

Starling, a British mobile-only bank, has employed influencer marketing campaigns. Their social media campaigns aimed to boost customer awareness of their mobile-only approach to banking and tempt new customers to open an account.

4. Angel Broking

Angel broking aimed at creating an awareness of their share market app by unraveling features and offers in a video format across YouTube through leading stock market influencers in the finance industry. They aimed at educating their audiences on the ease of creating Demat accounts and the steps involved.

Monzo opted for an influencer marketing approach to gain new customers. They also want to be known for delivering outstanding customer service and successfully securing crowdfunding.

5. Monzo

6. Klarna

Klarna adopted influencer marketing in style with one of the pioneers of Hip Hop. Snoop Dogg can resonate with a lot of things, and finance is not typically one of them. Klarna rebranded with a marketing campaign focused on design. Their campaign ‘Smoooth’ featured lots of random items, and the video ad climbed the charts reaching over 15 million views.

Conclusion

Influencer marketing is not a new channel of marketing. In fact, influencer marketing is a very important marketing strategy, especially if you are trying to gain market share with Gen Z and millennials. Many community banks, credit unions, and financial services businesses like to say that they are friendly and approachable. Influencer marketing gives your fintech brand an opportunity to prove this by conveying messages in distinctive and memorable ways.

Confluencr, being a global influencer marketing agency has pioneered influencer marketing solutions that have now become a staple part of the BFSI marketing mix. In India, we work with 4 out of the top 5 discount brokers, leading insurance firms, global consumer banks, cryptocurrency platforms and many other financial investment brands. With the restraints that apply to finance brands, it’s rather tough to create marketing campaigns that can truly promote the offerings. We have aptly leveraged influencers for an industry that needed to find newer avenues, to shed off its primary image as boring or dull, and therefore now attracting a younger audience as well. Like we did for TradeSmart, one of India’s fastest growing online discount broking firms. To similarly implement influencer marketing for your brand, reach out to us at [email protected].